There are many differences between 1099 contractors and W2 employees defined by nuances and exceptions in the governing laws, tests, and definitions of these two types of workers. As the business landscape continues to evolve, independent contractors are playing Independent contractor vs employee an increasingly important role. In many industries, independent contractors are seen as a cost-effective and flexible solution to various workforce needs. As a result, there is a growing demand for independent contractors across a wide range of industries.

In most cases, hiring a local employee is relatively straightforward from a tax and legal perspective. In most countries, you are obliged to settle your employees’ social security and health insurance contributions, and also make additional contributions of your own. For instance, if the state health insurance contribution is 18%, 8% may be taken from your employee’s salary, and the remaining 10% paid by you. Employees and independent contractors usually have vastly different levels of autonomy, with the latter generally getting free reign (within the framework of pre-agreed deadlines). Companies often use SOWs when they cooperate with external third parties, such as service providers and independent contractors.

Independent Contractor vs Employee?: What is the Difference

In other words, the mere existence of such a contract does not mean a worker is not an employee—all the factors must be reviewed to make that determination. In other words, the right to control is a critical element when determining whether the employee is an independent contractor or an employee. Each state follows its statutes, regulations or policies to determine whether an employer-employee relationship exists. Being classified as an independent contractor does not prohibit you from seeking UI. That’s because a business has to pay unemployment insurance on each employee.

The NLRB’s General Counsel Targets Employee Non-Competes … – Kutak Rock LLP

The NLRB’s General Counsel Targets Employee Non-Competes ….

Posted: Thu, 17 Aug 2023 14:03:05 GMT [source]

As a client, you don’t have to worry about withholding taxes for contractors you engage. They pay what’s known as self-employment (SE) tax, which includes both the employer and employee halves of Social Security and Medicare (FICA). By definition, an independent contractor, also known as an IC, is an individual who provides services to the general public under a contract.

Common Examples of An Independent Contractor

While real estate agents have some flexibility in their work schedule, they are also subject to certain rules and regulations set by their brokers. As with everything in life, being an independent contractor comes with ups and downs. If the person is integral to the company’s business and their work cannot be easily replaced, this is an indication that they are more likely to be classified as an employee.

During peak business periods, to perform services that are not a part of an employer’s regular business or to work on a special assignment, employers may turn to independent contractors to fill those roles. Independent contractors are responsible for their own taxes, therefore employers are not required to pay employment taxes or to withhold state, federal, or local taxes from paychecks to independent contractors. Independent contractors are not entitled to benefits from the company, such as health insurance or retirement, and are ineligible for unemployment benefits.

vs W2: 10 Key Differences

Anyone who performs services for KU is an employee, IF the University has the right to control what will be done and how it will be done. KU generally has to withhold and pay income taxes, social security, Medicare and unemployment taxes on wages that we pay to an employee. Chapter 443, Florida Statutes, governs whether services performed constitute employment subject to the Florida Reemployment Assistance Program Law. This law provides that employment includes service performed by individuals under the usual common law rules applicable in determining an employer-employee relationship.

If the University has control only to direct the result of the work and not the means and methods of accomplishing the result, then a person ordinarily is not an employee. As a condition to being allowed to work, employers sometimes require workers to sign an agreement stating that the worker is an independent contractor. Any label that you or the employer give to the relationship, even in an agreement signed by you, is irrelevant. Instead, what matters is whether the reality of the situation indicates that you are economically dependent on the employer (an employee) or in business for yourself (an independent contractor).

Employee vs. independent contractor: What’s the difference?

In that case, the IRS is more likely to consider the worker as an employee. In other words, if you can dictate the worker’s way of doing the job, then the worker classifies as an employee. When the IRS looks at who is an employee and who isn’t, they look at all the facts and circumstances within that situation.

Proper classification of individuals is critical to appropriately process and make payments for services. Under the United States Internal Revenue Service (IRS) and other agency guidelines, Northwestern has certain responsibilities. Independent contractor payments must be tracked for taxable income reporting on Form 1099, and employee payments are subject to employment taxes and are reportable on Form W-2. Errors in employee/non-employee classification may lead to significant fines and penalties due to lack of appropriate income reporting, tax withholding, or provision of benefits. One of the most significant differences between independent contractors and employees is how they are taxed. When you are an employee, your employer withholds taxes from your paycheck.

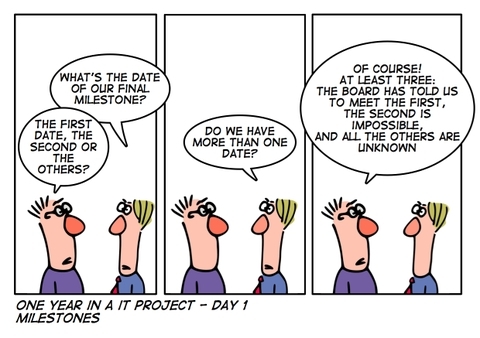

Common Issues That Remote IT Teams Face And How To Surpass Them

The most successful contractors have specialized skills that suit short-term projects. Clients hire them to complete a job, they agree to a fee and deadline, and the contractor completes the work based on the agreement. Once the project is done, the relationship ends, unless another opportunity to work together comes up. The FLSA’s definition of employment was designed to be broad and provide expansive coverage for workers. An agreement between a worker and an employer that labels the worker as an independent contractor is not determinative when evaluating the worker’s status. The rights of a worker depend on whether the person is an employee or an independent contractor under the law.

The recipient of the payment must also receive a copy of the 1099-MISC form. If the person is required to render their services personally, this is a strong indication that they are an employee. If the person meets all the below 20 points, they are classified as an independent contractor. However, if they fail to meet even one point, they are classified as an employee.

Hiring goals

Financial Control

Facts that show the department has the right to control the business aspects of the worker’s job indicate an employment relationship. An employee is usually guaranteed a regular wage amount for an hourly, weekly or other period of time. It is important to note that some workers have special rules which do not really fall under the laws for independent contractors vs. employees. These include emergency workers, workers for elections, elected and public officials, and medical residents.

Getting Them to the Table: Labor Board Imposing Mandatory … – Barnes & Thornburg

Getting Them to the Table: Labor Board Imposing Mandatory ….

Posted: Mon, 14 Aug 2023 19:34:52 GMT [source]

If you classify an employee as an independent contractor and you have no reasonable basis for doing so, then you may be held liable for employment taxes for that worker (the relief provisions, discussed below, will not apply). In determining whether the person providing service is an employee or an independent contractor, all information that provides evidence of the degree of control and independence must be considered. The onboarding and training processes also differ greatly between contractors and employees. Full-time employees, in contrast, require lengthy onboarding processes to understand the intricacies of team dynamics, the company culture and overall goals.

- Full-time employment is still the standard, but contract work is gaining ground.

- For instance, suppose you hire four workers to manage the orders at your coffee shop at an hourly payment of $30.

- Classification as an independent contractor instead of an employee causes you to lose other important rights.

- Now, you know why it is crucial to understand independent contractors vs. employee taxes.

Specialized skills relate to people’s specific talents or capabilities, and whether those skills make them fit for a job. They may be hard skills directly linked to a position (i.e. knowledge of programming languages), or be more generic soft skills, such as strong communication. The consequences for misclassification vary depending on whether the misclassification is deemed intentional. Another major difference between a contractor and an employee relates to their level of independence.